USA rank 3rd in the world for card fraud incidents

On average, 30% of consumers globally have experienced card fraud in the

past five years. Even more, 14 out of 17 countries saw an increase in fraud between 2014 and 2016. However, the US is one of the hardest hit which saw 47% of consumers experience fraud, has the third-highest rate of fraud worldwide, and was the only country to remain in the top three from 2014 to 2016.

Consistently high US fraud is likely due to two key factors. Because card spend in the US is so high, fraud rates in the country are likely to be high. But two ongoing issues exacerbate US card fraud in particular:

- (1)Dragging EMV adoption: Once implemented, EMV will vastly improve the security of card-present transactions. But just 2% of US card-present transactions were EMV-compliant in 2015. That’s because, on the issuer end, it’s costly and time-consuming to upgrade all customers to chip cards, which has slowed down the process. And on the merchant front, a bottleneck in certification and installation has prevented merchants from switching on EMV terminals, which has delayed their ability to accept chip card transactions. That means fewer transactions are secure, which could lead to increased fraud.

- (2)-Growing eCommerce fraud: But at the same time, digital shopping is increasing — Security First Merchant Services, LLC forecast that e-commerce will grow to $632 MMM* by 2020, up from $303 MMM* in 2014. And as the EMV migration accelerates and begins to improve in-store payment security, fraudsters will shift focus toward e-commerce sites, which could contribute to overall fraud growth.

cardholders and Merchant Reactions

cardholders and Merchant Reactions

- Customer trust and loyalty decreases following a fraud incident.

In the US, just 6% of customers change financial institutions following fraud incidents. But up to 30% of users opt to use cash or an alternative payment method following a card fraud incident. - If it continues on a large-scale, that could impact costs for card providers.

That’s because when fraud does occur, it’s expensive — credit card fraud cost issuers roughly $10 Dollars per card issued in the past year, for example. That, combined with the consequences from shifting trust and loyalty, like decreased card usage or required investments in new customer acquisition and brand reputation, could rack up costs for these providers.Fraud cost U.S. retailers approximately $32 MMM* in 2014, up from $23 MMM* in 2013. To solve the card fraud problem for all merchant types in store (retail/restaurant), online (shopping carts), and mobile payment solutions (card readers); payment for companies (SFMS) and merchants are implementing new payment protocols that could finally help mitigate fraud incidents.*MMM=Billion

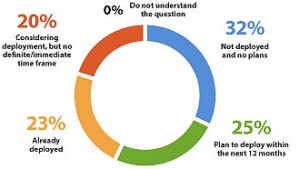

Security First Merchant Services, LLC Solutions are:

Tokenization increases the security of transactions made online and in stores.

Tokenization schemes assign a random value to payment data, making it effectively impossible for hackers to access the sensitive data from the token itself. Tokens are often “multi-use,” meaning merchants don’t have to force consumers to re-enter their payment details.

Point-to-point encryption is the most tightly defined form of payments encryption. In this scheme, sensitive payment data is encrypted from the point of capture at the payments terminal all the way through to the gateway or acquirer. This makes it much more difficult for fraudsters to harvest usable data from transactions in stores and online.EMV Cards embedded microchip for added security. The chip also generates dynamic cryptograms when the card is inserted into a payment terminal. Because these cryptograms change with every purchase, it makes it difficult for fraudsters to make counterfeit cards that can be used for in-store transactions.

Security First Merchant Services, LLC since its 2008 inception has offered fraud prevention protocol at no additional cost to all our merchants hence, our company name and obvious value add in our industry.